The Case for Adding Darwin to Behavioral Economics

Following my first sabbatical—a two-year stint as a federal bureaucrat in Washington, DC—I resumed my teaching duties in Cornell’s department of economics in the fall of 1980. Shortly thereafter, I met Richard Thaler, who had started teaching economics in the university’s business school while I’d been away. Over the next several years, he and I spent long hours in conversation about how our own observations of people’s behavior were often strikingly at odds with the predictions of standard economic theory.

Thaler had spent his own recent first sabbatical working with the Israeli psychologists Daniel Kahneman and Amos Tversky, both renowned for their pioneering work on systematic cognitive errors. Thaler’s 1980 article, “Toward a Positive Theory of Consumer Choice,” which drew on that work, is now widely viewed as the paper that launched behavioral economics, a vibrant new field that has focused largely on the intersection of cognitive psychology and economics.1 (In October of 2017, Thaler was awarded the Nobel Prize in economics in recognition of that work.)

As Darwin saw clearly, individual incentives often lead to wasteful arms races.

In 1983, I taught the first undergraduate course ever offered in behavioral economics. Because few students had ever heard the term, my first challenge was to come up with a course title that might lure some to enroll. In the end, I decided to call it “Departures from Rational Choice” (a decision I later regretted, because it triggered fruitless debates over the meaning of rationality). Naturally, there was no standard syllabus then. After much deliberation, I decided to cover material under two broad headings: “Departures from Rational Choice with Regret,” and “Departures from Rational Choice without Regret.”

Under the first heading, I listed studies that document the many systematic cognitive errors to which most of us are prone. For example, although standard rational-choice models say that people will ignore sunk costs (costs that are beyond recovery at the moment of decision), such costs often influence choices in conspicuous ways. In one of Thaler’s celebrated examples, you’re about to depart for a sporting event at an arena 50 miles away when an unexpectedly heavy snowstorm begins. If your ticket is nonrefundable, your decision of whether to stay home should not be influenced by the amount you paid for it. Yet a fan who paid $100 for his ticket is significantly more likely to make the dangerous drive than an equally avid fan who happened to receive his ticket for free. The first fan is probably guilty of a cognitive error. People typically seem to regret making such errors once they become aware of them.

Under my “…Without Regret” heading, I listed studies that describe departures from the predictions of standard rational-choice models that people do not seem to regret. Consider an MBA student’s decision of how much to spend on an interview suit. The standard assumption in these models is that the primary determinants of the satisfaction provided by any good are its absolute attributes. But that’s clearly not true of the utility provided by an interview suit. If you’re one of several similarly qualified applicants who all want the same investment banking job, it’s strongly in your interest to look good when you show up for your interview. But looking good is an inherently relative concept. It means looking better than other candidates. If they show up wearing $500 suits, you’ll be more likely to make a favorable first impression, and more likely to get a callback, if you show up in a $3,000 suit than if you show up in one costing only $300. Spending more is rational from the individual job seeker’s perspective, but irrational from the perspective of job seekers as a group.

Behavioral economics as it developed over the next decades did not follow the roadmap outlined in my syllabus. Instead, it has focused almost exclusively on behavior under my first heading, departures with regret. This work on cognitive errors has had an enormous impact on policy makers. Governments around the globe have been inspired by it to set up behavioral-science advisory groups, popularly known as nudge units, to help citizens make better decisions. A study in the United Kingdom found that implementation of the British group’s recommendations had produced savings that exceeded the group’s costs by a factor of 20.2

Work that falls under my departures-without-regret heading has been far less extensive—so much so that an instructor putting together a syllabus for a behavioral economics course today might find the presence of that heading on my early-1980s syllabus somewhat puzzling.

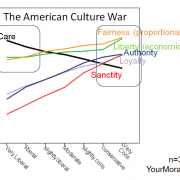

Traditional models of rational choice typically ignore what I view as Charles Darwin’s central insight—that life is graded on the curve.

I continue to believe, however, that economic losses under the without-regret heading are larger by several orders of magnitude than those under the with-regret heading. Losses from without-regret departures are also substantially more stubborn—because, unlike losses resulting from cognitive errors, they cannot be remedied by unilateral individual action. Once someone learns that it is a mistake to take sunk costs into account, for example, it becomes possible to ignore them unilaterally. Collaboration with others isn’t required. But collective-action problems are a different matter. It is one thing for job candidates to recognize that all would be better off if everyone spent less on interview suits. But absent an enforceable agreement for all to cut back in tandem, each candidate’s best bet is to continue spending.

As behavioral economics continues to evolve, it would profit from adopting an even broader interdisciplinary perspective, drawing on the insights not just of economics and psychology, but also those of evolutionary biology. Traditional models of rational choice typically ignore what I view as Charles Darwin’s central insight—that life is graded on the curve. It’s not how strong, fast, or clever we are that matters, but rather how those traits compare with those of rivals. When context influences our ability to achieve important goals, as in the interview-suit example, all bets regarding the efficacy of Adam Smith’s invisible hand are off. Notwithstanding the uncritically enthusiastic pronouncements of many of Smith’s modern disciples, unbridled market forces often fail to channel the behavior of self-interested individuals for the common good. On the contrary, as Darwin saw clearly, individual incentives often lead to wasteful arms races.

Subscribe to the Ethical Systems newsletter

The losses from these arms races are often epic in scale. One of the most robust findings from the large and contentious literature on the determinants of human well-being is that beyond a certain point—one that has long since been passed in the developed world—across-the-board increases in many forms of private consumption produce no measurable gains in health or life satisfaction.3 If all mansions were to double in size, for example, those living in them would be neither happier nor healthier than before. Existing research thus does not permit us to conclude with confidence that Americans were meaningfully better off in 2018 than in 2012, even though the inflation-adjusted total value of the nation’s goods and services was more than $2 trillion higher in 2018.

Now imagine that someone had possessed a magic wand that could have rearranged our 2012 spending patterns—say, by making the largest houses somewhat smaller, cutting expenditures on automobiles and interview suits, and reducing outlays on wedding receptions, coming-of-age parties, and the like. The resulting savings could have been spent to shorten the workweek by a few hours and provide an additional two weeks of vacation time for everyone. And more could have been spent to repair our decaying infrastructure.

Existing evidence leaves little doubt that expenditure shifts of this sort would have caused clear gains in well-being for 2012 Americans, gains that would enable us to say: Americans living in this rearranged version of 2012 would have been happier and healthier than actual Americans in 2018. Even though those in the first group were $2 trillion poorer. Unless we are willing to deny the validity of that evidence, the clear implication is that our current spending patterns are wasting at least $2 trillion annually in the United States alone, a sum that almost surely dwarfs the losses caused by cognitive errors.

The things we buy are of course not the only choices that are influenced by others. As psychologists have long said, “It’s the situation, not the person.” When we see someone behave in a particular way, our impulse is to ask what sort of person would do such a thing. Psychologists say that’s the wrong way to think about it. The behavior we observe is more often driven by the social forces surrounding the actor than by traits of character and personality. Sometimes those forces influence us for ill, as when people who smoke lead their friends to take up the habit. But social influence can also be positive, as when time spent with friends who eat prudently and exercise regularly makes people more likely to adopt healthful lifestyles.

All this is uncontroversial. Also uncontroversial is that the causal arrows run in both directions—that the social environment is itself a consequence, in the aggregate, of our own choices. The smoking rate, for example, is just the number of us who smoke divided by our total number. But because the effect of any individual choice on the social environment is minuscule, people typically ignore that second causal pathway. Few express concern, for example, that their decision to smoke might make others more likely to do so.

Are there simple policy measures that would encourage us to consider how our choices affect social environments? Cigarette taxation provides an informative case study.

Because nicotine is one of the most highly addictive substances, even large increases in the price of tobacco products typically produce only small reductions in consumption for those already addicted. And the initial declines in smoking rates were indeed modest in the 1980s, when American regulators began imposing significant taxes on cigarettes and restrictions on where people could smoke. Yet a small proportion of smokers did quit soon after the taxes began, and higher prices also induced a modest number of others to refrain from starting. And because smoking is highly contagious, those initial responses launched a powerful dynamic. They induced still others to quit or refrain from starting, and in every succeeding year, rates continued to fall. The cumulative effect of these responses was dramatic: The adult smoking rate in the US is now less than one-third of what it was in the mid-1960s.

Yet regulators did not invoke behavioral contagion as a rationale for cigarette taxation. Rather, they defended their restrictive measures by citing recent studies showing that exposure to second-hand smoke increased the incidence of serious illnesses among hapless bystanders. But the harm from such exposure, although real, is minuscule compared to the harm from actually being a smoker. By far the greater harm caused when someone becomes a smoker is the injury suffered by others thereby influenced to take up the habit. It’s a huge effect. One study estimated, for example, that when the proportion of smokers among a teen’s friends rose from 20 to 30 percent, she became 25 percent more likely to become or remain a smoker.

I use the term “behavioral externalities” to describe choices that affect social environments in these ways. Because social environments influence us so profoundly, both for good and ill, we have a powerful and legitimate interest in them. We would prefer to live in ones that bring out the best in us and to avoid those that harm our interests. Yet behavioral externalities have received virtually no serious attention from policy analysts, and it’s here that lie many of the most exciting opportunities for young researchers. Once you’ve been alerted to their existence, it quickly becomes apparent that behavioral externalities are ubiquitous.

Careful empirical studies have documented the importance of behavioral contagion in such diverse domains as, among many others, excessive drinking, sexual predation, cheating, bullying, obesity, greenhouse-gas emissions, and compliance with public-health directives. Research has tended to focus on negative peer influences, but there is also compelling evidence of positive influences. The adoption of rooftop solar panels, hybrid cars, and plant-based diets, for example, have all been shown to be highly contagious.4

By its focus on systematic cognitive errors, behavioral economics has greatly increased our understanding of why people’s choices often fail to match those predicted by traditional rational-choice models. But our failure to take full advantage of existing opportunities owes less to such errors than to our embeddedness in complex social structures. As Darwin understood clearly, our fate depends not only on our own decisions and capabilities but also on those of rivals and partners. And that, in a nutshell, is the case for a broader and more inclusive behavioral economics, one that incorporates the rich insights of behavioral biology.

Robert H. Frank is an Ethical Systems collaborator and a New York Times economics columnist and the author, most recently, of Under the Influence: Putting Peer Pressure to Work. Follow him on Twitter @econnaturalist.

References

- Richard H. Thaler, “Toward A Positive Theory of Consumer Choice,” Journal of Economic Behavior and Organization, 1 (1), March 1980: 39-60.

- The Economist, “Policy Makers Around the World are Embracing Behavioral Science,” May 18, 2017.

- For an extensive summary of that literature, see chapters 5 and 6 of Robert H. Frank, Luxury Fever, NY: The Free Press, 1999.

- For a review of the relevant studies, see Robert H. Frank, Under the Influence, Princeton: Princeton University Press, 2020.

Read the entire Advice to an Aspiring Economist series:

1. Introduction by David Sloan Wilson

2. Some Pessimistic Advice to an Aspiring Economist by Geoffrey Hodgson

3. The Invisible Hand is a Wishful Invention by Alan Kirman

4. The Case for Adding Darwin to Behavioral Economics by Robert Frank

5. A War Between the Economy and Earth by Lisi Krall

6. The Good, the Bad and the Ugly Truths of Being an Economist by John Gowdy

7. Do zee Chimpanzees Have zee Credit Card? by Terrance Burnham

Lead image: Bryan Jones / Flickr

Reprinted with permission from TVOL Magazine.