The Dirty Secret of Over-Performing ESG Funds, and More, in a Q&A with Alison Taylor

Praveen Gupta, formerly the Managing Director & CEO at Raheja QBE General Insurance Company Ltd, recently interviewed Alison Taylor on his blog. We’re glad to be sharing the conversation, which hits a wide range of topics, with you here.

The pandemic, precarious climatic developments, racial polarization, and presidential elections together made 2020 a heady mix. Does the United States seem to be at war with itself?

Yes! Polarization is an issue in a number of liberal democracies, but there are particular historical, cultural, and structural reasons why these dynamics have got so out of hand in the United States. I recommend Ezra Klein’s Why We’re Polarized if any of your readers would like to get a deeper understanding of these issues. I don’t think it is melodramatic to say that democracy in the United States is in crisis, and the next four years will be very telling in terms of whether the country is able to moderate some of these unhealthy forces or whether it will head further into crisis territory. I am particularly concerned by the lack of a shared reality today. The founder of Ethical Systems, Jonathan Haidt, likens the situation to the Tower of Babel, where we are unable to make shared sense of what is going on around us anymore.

Is there anything in particular leading to the lack of shared reality?

It is about media fragmentation and manipulation—before the rise of the internet and social media, there was a level of agreement on facts that no longer exists, and this makes any effort at political change exponentially more challenging.

The best hope for moving forward is regulation, not voluntary standards, which will be self-serving.

Despite “mother nature” pushing back “father greed,” is it correct to surmise that climate change is still a preserve of the activists or at best their sympathizers. Does much of America continue to indulge in a wasteful lifestyle?

I actually see some more positive signs here—more Americans across the political spectrum acknowledge the reality of climate change, and there has been a dramatic shift in sentiment among younger people. There is no particular reason that climate change needs to be a polarized political issue; indeed, Republicans are more rural and certainly can be extremely environmentally focused. However, the framing of mother nature as oppositional to father greed could undermine prospects for progress in terms of the American mindset, where change will be most likely if the market opportunities of renewable energy, and similar emerging businesses, gain more momentum.

America is a fundamentally individualistic and capitalist society. The best hope of making progress on climate change will still likely come from arguments that take economic opportunity as their starting point, or at least aim to create “shared value.” It is true that socialism is seen in a more positive light by progressive young Americans, and over the long term we may see a more fundamental shift in ideas of what the economy is for. But a market-driven solution is still the most pragmatic option in the short term.

The Green New Deal still sounds like a distant dream. Do you see climate activism as a moral compass and a compelling driver for the new government to be?

I do. But the government is seriously constrained in how much room for maneuvering it has, particularly if the Senate remains in Republican hands. Over the long term, commitment to environmental responsibility is growing across the political spectrum, and the commitment of US businesses to addressing climate change seems to have far more momentum than other sustainability issues, which will help. We are also starting to see some encouraging signs in terms of financial regulation of climate risk. But the government’s ability to secure the Green New Deal in the short term is constrained, not just by political realities but by the lack of shared reality and the overwhelming prevalence of misinformation, such as rhetoric that the Democrats will ban hamburgers!

Subscribe to the Ethical Systems newsletter

Do cross-directorship and sometimes cross-holding, via banks and fund managers on insurance-company boards, pose a systemic ethical risk?

Conflicts of interest pose ethical risks not just in terms of cross-holdings between banks and insurance, but also the revolving door between the private sector and regulatory agencies. Institutional, legal corruption is arguably one of our biggest global challenges right now. It stymies our ability to address a wide range of systemic problems such as climate change and inequality. We are starting to see significant bipartisan movement on financial integrity and money laundering, but there is a very long way to go.

The ethics deficit seems to be going way beyond the dominant owners of fossil-fuel companies and financial institutions, including insurers. Are non-executive directors and professional managers bound by their profession’s (auditors, accountants, underwriters, engineers, lawyers, and many others) ethical conduct? Shouldn’t they be rebelling?

There is quite a bit of rebellion in the younger ranks of law, consulting and accounting firms, but it is not until we see younger generations take on leadership roles that we will seriously be able to address these issues. The problems at McKinsey and EY are illustrative of a wider need to regulate the “gatekeepers” that facilitate much of the unethical conduct in the global financial system. Firms are starting to take action, but asking partners to decline six-figure projects for reputational concerns will remain unrealistic until the reputational risk becomes overwhelming. All these industries are also unusually resistant to oversight.

Is it still counterintuitive for asset managers and bankers obsessed with returns to wind down industries while they are still profitable? Is the resultant double standard fueling greenwashing?

What is happening is that asset managers know the writing is on the wall for fossil-fuel companies. But there are questions of how the industry evolves, who will be able to pivot, and who is left standing last. There is a tendency to bet on both renewable energy and fossil fuels as a way of hedging risk and opportunity. This is quite rational, but certainly can end up sending a highly hypocritical and self-serving message to those who want to see change happen faster. I recommend this article on the subject: https://www.greenbiz.com/article/if-i-was-right-why-was-i-fired.

Today, much practice is based on anecdotes, consultants’ intuition, and pointless benchmarking of what other companies are doing.

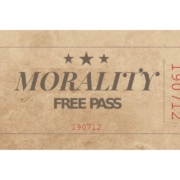

Is ESG the way forward? British billionaire-investor Chris Hohn has said that most ESG investment funds are “a total greenwash” and that investors “need to wake up and realize that their asset managers talk but don’t actually do.”

Well, the dirty secret of why ESG funds have over-performed the market this year is of course that they are overweight on technology stocks, which are “green” in terms of climate but have considerable other ESG issues. ESG can be very effective as a way to drive change but there remain immense challenges with analyzing and contextualizing ESG performance and commitments by companies. Doing it well requires deep engagement with the business, but investors are looking for a quick tick-box solution, a universal standard—something where they can check the box and move on to the topics they are more comfortable with. Sustainability measurement and accounting today is often compared to mainstream accounting before it consolidated and became consistent—but measuring ESG performance is exponentially more complicated than even agreeing on a common set of financial standards to report against. I alternate between hope and despair on this question!

What’s the key challenge and the possible solution for ESG?

We frame everything in terms of the “business case,” and there seems to be wide acceptance that nothing happens without it. The best hope for moving forward is regulation, not voluntary standards, which will be self-serving.

What necessitated the creation of Ethical Systems? What is your vision?

Ethical Systems was created in 2014 by prominent author and professor Jonathan Haidt with the goal of making business ethics a cumulative science. Our goal is to advance the field of business ethics with rigorous research to determine what works to drive change in real organizations. Today, much practice is based on anecdotes, consultants’ intuition, and pointless benchmarking of what other companies are doing. We aim to act as a bridge between academia and the corporate world and translate the best ideas from academic research into business practice. This is inherently challenging for all sorts of reasons, but so many of our problems today are unprecedented that perhaps the time is finally right!

Do you foresee a bipolar world of governance till such time everything migrates to ESG?

I do think it is likely that we will start to see a gulf opening up between companies that embrace stakeholder capitalism and ESG rhetoric, and those that continue to maintain an approach grounded in maximizing short-term shareholder value. We can already see this in the differentiated responses to the coronavirus. It is often held that consumer facing companies have more reputational risk and will be the first to act, while B2B companies experience less pressure to adopt sustainable practices. However, large multinationals are pushing the adoption of ESG standards through their supply chains, and this will greatly accelerate adoption of such standards.

Praveen Gupta writes about the exciting intersections of the climate crisis, diversity, governance, risk, and tech on The Diversity Blog, where this interview was originally published.