Tag Archive for: Azish Filabi

End of Year Letter, 2018, from Jon Haidt and Azish Filabi

Blog

FCA UK Culture Conference Event Summary & Next Steps

Blog At the recent Financial Conduct Authority March 2018 meeting in London, Ethical Systems Executive Director Azish Filabi and collaborator Celia Moore participated in panels featuring fellow experts discussing current, pressing issues in regards to culture, regulation, ethics and compliance in the financial sector.

At the recent Financial Conduct Authority March 2018 meeting in London, Ethical Systems Executive Director Azish Filabi and collaborator Celia Moore participated in panels featuring fellow experts discussing current, pressing issues in regards to culture, regulation, ethics and compliance in the financial sector.

A Behavioral Science Approach to Bank Culture, with Azish Filabi

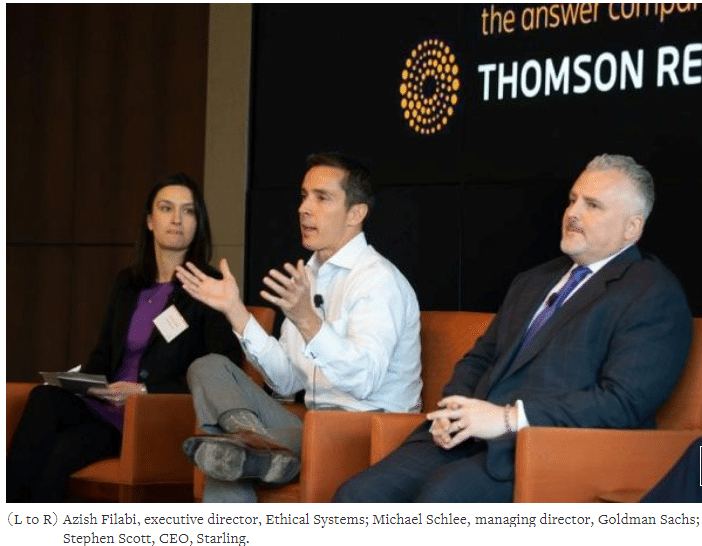

Blog At a recent Thomson Reuters forum in New York on culture and behavioral science in the banking industry, Ethical Systems' Executive Director Azish Filabi joined a panel with fellow experts to discuss how research and data helps shape ethics and culture.

At a recent Thomson Reuters forum in New York on culture and behavioral science in the banking industry, Ethical Systems' Executive Director Azish Filabi joined a panel with fellow experts to discuss how research and data helps shape ethics and culture.

We invite you to read a piece on Reuters on the event featuring the following takeaways we share in this blog. Video from the event is also embedded.

Creating and Maintaining a Healthy Corporate Culture: RANE podcast with Azish Filabi

Blog In this podcast, (Risk Assessment Network + Exchange) RANE’s Serina Vash sits down with Azish Filabi, Executive Director, Ethical Systems, to discuss what drives a healthy corporate culture and best practices for creating and maintaining that culture. Through research and collaboration with the best academics in the field, Azish dedicates her time to helping businesses assess and promote ethical behavior and culture in their organizations.

In this podcast, (Risk Assessment Network + Exchange) RANE’s Serina Vash sits down with Azish Filabi, Executive Director, Ethical Systems, to discuss what drives a healthy corporate culture and best practices for creating and maintaining that culture. Through research and collaboration with the best academics in the field, Azish dedicates her time to helping businesses assess and promote ethical behavior and culture in their organizations.

Middle Meddling: Management and ethics

Blog Goal setting is often a subject of discussion about behavioral ethics and internal programs. We’ve seen in recent cases such as at Wells Fargo and Volkswagen how cheating and lying become the norm when performance goals are not reasonably achievable. Recent evidence in a paper by Niki den Nieuwenboer, João da Cunha, and ES collaborator Linda Treviño shows the internal dynamics and processes that lead directly to cheating behaviors.

Goal setting is often a subject of discussion about behavioral ethics and internal programs. We’ve seen in recent cases such as at Wells Fargo and Volkswagen how cheating and lying become the norm when performance goals are not reasonably achievable. Recent evidence in a paper by Niki den Nieuwenboer, João da Cunha, and ES collaborator Linda Treviño shows the internal dynamics and processes that lead directly to cheating behaviors.

The researchers, one of which was embedded inside the company, observed managers and sales staff over 15 months at a large (10,000 employees) telecommunications company. The company had established goals for its desk sales teams designed to motivate productivity, including a target for sales as well as sales-related work, such as making cold calls to customers, and gathering information about potential customers, among other planning activities.

Azish Filabi Presents on Measuring Corporate Culture at the 2018 OECD Conference

Blog Last week, the Organisation for Economic Co-operation and Development (OECD) had its annual Anti-Corruption and Integrity Forum at their headquarters in Paris. Entitled Planet Integrity: Building a Fairer Society, over 2,000 attendees discussed how integrity plays a role in improving economic inequality, enhances the benefits of public policies and government programs, and more broadly equalizes the gains of globalization.

Last week, the Organisation for Economic Co-operation and Development (OECD) had its annual Anti-Corruption and Integrity Forum at their headquarters in Paris. Entitled Planet Integrity: Building a Fairer Society, over 2,000 attendees discussed how integrity plays a role in improving economic inequality, enhances the benefits of public policies and government programs, and more broadly equalizes the gains of globalization.

Ethical Systems won one of the OECD Research Edge competition awards. The paper, co-written by Caterina Bulgarella and myself, provided the summary of our culture assessment framework, which demystifies an often complex organizational issue: how to define and measure ethical culture.

COMMENTARY: Safeguarding financial firm cultures: five focus factors for directors

Blog Board members have the difficult job of overseeing the success of a firm without getting involved in day-to-day management or operations. Increasingly, they are expected to understand compliance and other risks of misbehavior, particularly as those risks have been shown to impact financial performance.

Board members have the difficult job of overseeing the success of a firm without getting involved in day-to-day management or operations. Increasingly, they are expected to understand compliance and other risks of misbehavior, particularly as those risks have been shown to impact financial performance.

In a commentary I co-wrote with Mike Silva, Partner and Chair of the Financial Services Regulatory practice at DLA Piper, we emphasize the role of corporate culture in promoting good behavior as well as financial stability.

NY Fed Offers New Insights for Financial Services Firms

Blog There are two new resources on the Governance and Culture Reform site of the Federal Reserve Bank of NY that highlight the regulatory trends with respect to managing culture in financial services firms.

There are two new resources on the Governance and Culture Reform site of the Federal Reserve Bank of NY that highlight the regulatory trends with respect to managing culture in financial services firms.

The first is a transcript from an event at Thomson Reuters on February 7, 2018, which was a moderated discussion among Bill Dudley (President of the NY Fed), Bill Rhodes (WR Rhodes Global Advisors), and Ellen Alemany (Chairwoman and CEO of CIT Group), moderated by Rob Cox (Reuters News). The panelists covered a wide array of matters relating to the topic of Banking Culture: Still room for reform?

Dudley highlighted that while some progress has been made, there’s still much room for improvement. For example, the NY Fed has proposed a banking registry to keep track of whether employees have left their jobs for reasons of fraud or other misconduct. This would address the so called “rolling bad apples” problem, whereby companies may inadvertently hire a rogue employee of another firm because employment law discourages employers from sharing potentially derogatory information about former employees. He mentions that the U.K. has perhaps made more progress on this matter, having already established a similar registry.

The Ethics & Compliance Initiative Partners with Ethical Systems

News ARLINGTON, VA, February 7th, 2018 – The Ethics & Compliance Initiative (ECI), the nation’s oldest ethics research and best practice community, today announces a partnership with Ethical Systems, a research collaboration comprised of the nation’s leading scholars specializing in the study of ethical culture and behavior in organizations. As two respected thought leaders who share a common interest in advancing the highest standards of ethical behavior in organizations, this partnership will provide a platform for both parties to conduct joint research, to develop new metrics, and to expand their reach with new insights that will shape best practice in organizational ethics.

ARLINGTON, VA, February 7th, 2018 – The Ethics & Compliance Initiative (ECI), the nation’s oldest ethics research and best practice community, today announces a partnership with Ethical Systems, a research collaboration comprised of the nation’s leading scholars specializing in the study of ethical culture and behavior in organizations. As two respected thought leaders who share a common interest in advancing the highest standards of ethical behavior in organizations, this partnership will provide a platform for both parties to conduct joint research, to develop new metrics, and to expand their reach with new insights that will shape best practice in organizational ethics.

“This partnership has great promise to significantly enhance our understanding of the importance of ethics and culture in organizations,” said Patricia Harned, ECI’s CEO. “ECI is delighted to be able to work closely with the most highly regarded scholars in our industry, and we look forward to the collaboration that we know will benefit organizational leaders and students in higher education.

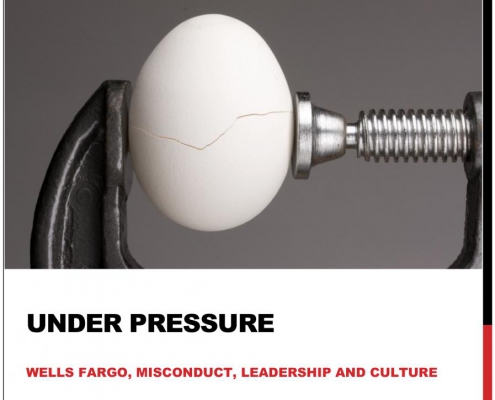

Under Pressure: Wells Fargo, Misconduct, Leadership and Culture

Blog Consistent with our mission to bring timely and relevant research to the business ethics community, Ethical Systems has just published a new electronic resource: Under Pressure: Wells Fargo, Misconduct, Leadership and Culture [updated May 2018 to include a new Executive Summary and further details about the case]

Consistent with our mission to bring timely and relevant research to the business ethics community, Ethical Systems has just published a new electronic resource: Under Pressure: Wells Fargo, Misconduct, Leadership and Culture [updated May 2018 to include a new Executive Summary and further details about the case]

This case study, created by Bharathy Premachandra, our 2017 Bryan Turner Intern in Business Ethics, with Azish Filabi, Executive Director of Ethical Systems, spotlights the lessons learned from the recent scandal at Wells Fargo around false accounts, inflated sales targets and misguided directives from bank executives.