Tag Archive for: banking

Why the Global Financial Crisis Is Bound to Be Repeated

Blog, Corporate Culture, Incentives, Personality & Personnel

New Evidence Shows How Gender Diversity Improves Banking Culture

Blog, Corporate Culture, Corporate Governance, Ethics Pays, Leadership

Inquiry into Australia’s Banking and Finance Industry

BlogBy Dennis Gentilin, founding director of Human Systems Advisory and an adjunct fellow at Macquarie University. He was employed at the National Australia Bank for 16 years.

As readers of this blog may know, there is currently an inquiry into the banking and finance industry in Australia. Prime Minister Malcolm Turnbull announced The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry in November 2017. Former High Court Judge Kenneth Hayne AC was appointed as the commissioner shortly after the announcement and public hearings commenced earlier this year.

As readers of this blog may know, there is currently an inquiry into the banking and finance industry in Australia. Prime Minister Malcolm Turnbull announced The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry in November 2017. Former High Court Judge Kenneth Hayne AC was appointed as the commissioner shortly after the announcement and public hearings commenced earlier this year.

FCA UK Culture Conference Event Summary & Next Steps

Blog At the recent Financial Conduct Authority March 2018 meeting in London, Ethical Systems Executive Director Azish Filabi and collaborator Celia Moore participated in panels featuring fellow experts discussing current, pressing issues in regards to culture, regulation, ethics and compliance in the financial sector.

At the recent Financial Conduct Authority March 2018 meeting in London, Ethical Systems Executive Director Azish Filabi and collaborator Celia Moore participated in panels featuring fellow experts discussing current, pressing issues in regards to culture, regulation, ethics and compliance in the financial sector.

A Behavioral Science Approach to Bank Culture, with Azish Filabi

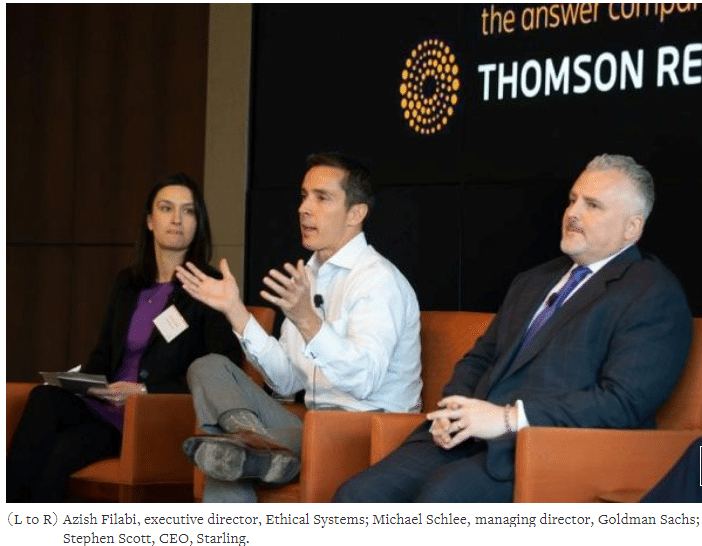

Blog At a recent Thomson Reuters forum in New York on culture and behavioral science in the banking industry, Ethical Systems' Executive Director Azish Filabi joined a panel with fellow experts to discuss how research and data helps shape ethics and culture.

At a recent Thomson Reuters forum in New York on culture and behavioral science in the banking industry, Ethical Systems' Executive Director Azish Filabi joined a panel with fellow experts to discuss how research and data helps shape ethics and culture.

We invite you to read a piece on Reuters on the event featuring the following takeaways we share in this blog. Video from the event is also embedded.

Azish Filabi at The Banking & Finance Ethics 2017 Conference

BlogEthical Systems CEO Azish Filabi was invited to deliver the opening remarks at The Banking & Finance Ethics 2017 conference on June 8th in Sydney, Australia. The conference covered the importance of trust and an ethical foundation for the financial services sector; exploring the crucial role individuals play in ensuring that the industry operates with integrity. We present her address below

Retail Bank Incentive Schemes in Australia

Blog Dennis Gentilin is the author of “The Origins of Ethical Failures” (Routledge, 2016) and the Founding Director of Human Systems Advisory.

Dennis Gentilin is the author of “The Origins of Ethical Failures” (Routledge, 2016) and the Founding Director of Human Systems Advisory.

Last week, Mr Stephen Sedgwick AO released the findings from his review into remuneration arrangements for retail banking staff in Australia (the final report can be downloaded here). The review is part of a broader program of work being undertaken by the Australian Bankers Association that is aiming to address the culture and conduct issues within the banking sector.

With this objective in mind, the review represents a significant (albeit small) step in the right direction. Although some may question whether Mr Sedgwick went far enough, he has squarely placed the ball in the banks’ court and left them under no illusions that change is needed.

Bank Culture: Can regulators have an impact?

Blog A March 14 New York Times Dealbook article by David Zaring of the Wharton School looks at bank culture from a regulatory perspective and questions why NY FED regulators are taking on the grand task of attempting to make culture and ethics an important part of bank supervision- especially when “creating and regulating culture by regulatory fiat is so difficult.”

A March 14 New York Times Dealbook article by David Zaring of the Wharton School looks at bank culture from a regulatory perspective and questions why NY FED regulators are taking on the grand task of attempting to make culture and ethics an important part of bank supervision- especially when “creating and regulating culture by regulatory fiat is so difficult.”

Ethical Systems has made fortifying ethical corporate culture a main concentration of our efforts, as there is no better determinant to predicting misconduct. An ethical systems approach to business ethics considers the interplay between corporate culture with considerations for how to motivate individual to be more ethical (nudging),and the regulatory (guiding policies that impact behavior and outcomes).

When examining company culture, leaders should consider whether it is one in which company values are infused into all aspects of the operation, where managers lead by example and teams are encouraged to speak up about ethics and other issues? Or, if it is a culture in which checking the compliance boxes off a list is seen as most important and certain behavior is tolerated by high-performers but not allowed for others?

The UK’s Banking Standards Board: Should a US model follow?

Blog I recently returned from a trip to London, where I spoke about the role of ethics and culture in organizations with varied, leading professionals. My meeting with the Banking Standards Board (“BSB”) stands out as a potential model for what financial services firms in the U.S. could emulate.

I recently returned from a trip to London, where I spoke about the role of ethics and culture in organizations with varied, leading professionals. My meeting with the Banking Standards Board (“BSB”) stands out as a potential model for what financial services firms in the U.S. could emulate.

The BSB is a non-profit organization, established by the industry in the wake of the 2008 financial crisis to address core challenges relating to the culture of banking, and help restore the industry’s trust and reputation.

To raise standards of behavior in financial services, the BSB began with a comprehensive analysis of the current standards for culture, the details of which are provided in their 2015 assessment report, identifying themes relating to norms within the banking industry. After conducting assessments at individual firms, and extrapolating common themes, they plan to use these as the framework for future work plans. This assessment creates a baseline so that firms and the BSB can then measure the impact of reform efforts, both internal ethics programs and industry and regulatory initiatives, over time. As I’ve written in previous blog posts, evidence-based ethics research and culture measurement are key to determining what works to drive more ethical behavior in organizations. In order to improve culture, researchers need to help firms better measure their culture and track changes in indicators over time. The BSB has taken a vital step towards this goal.

Ethics and Wall Street: Reactions and Reform

Blog In the wake of the financial crisis of 2008, many thought ethics reform would come quickly to Wall Street. New laws did come, in the USA and UK. But is the culture changing for the better? A new report (The Street, The Bull and The Crisis: A Survey of the US & UK Financial Services Industry) suggests that there has been little change in the last three years, and there may be some worrying trends among younger employees.

In the wake of the financial crisis of 2008, many thought ethics reform would come quickly to Wall Street. New laws did come, in the USA and UK. But is the culture changing for the better? A new report (The Street, The Bull and The Crisis: A Survey of the US & UK Financial Services Industry) suggests that there has been little change in the last three years, and there may be some worrying trends among younger employees.

You can find a quick summary of the report in this article by NPR. To go beyond the summary, we asked our expert suite of collaborators for their reactions.

The bottom line is that better ethical behavior will come when legal reforms lead to, or are supplemented by, changes in the culture and norms of the financial industry. As Tenbrunsel explains, "Just more regulation without addressing the individual, organizational and industry-level factors probably isn't going to have a very significant impact." Addressing all of those factors simultaneously is our goal at Ethical Systems.